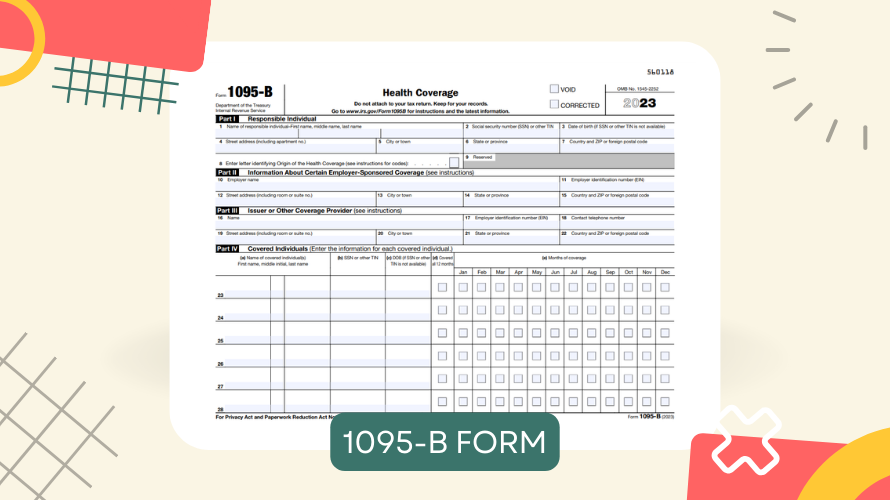

IRS Tax Form 1095-B

Form 1095-B is a critical document for taxpayers in the United States. The history of this form is intertwined with the implementation of the Affordable Care Act (ACA). If you have health coverage through an insurance provider that isn't the government, chances are, you've come across this form. So, let's dig a bit deeper into its background.

This tax form was introduced to make it easier for taxpayers to report their health coverage information to the IRS. It's important to remember that not all insurance providers will be required to send you IRS tax form 1095-B, but if they do, it's important to keep it with your tax records.

Key Modifications to the Federal Tax Form 1095-B

The federal tax form 1095-B has seen a variety of changes since its inception. The goal of these changes has always been to make the tax filing process easier for citizens. For instance, recent changes have resulted in the elimination of penalties for those who do not maintain health insurance coverage. This change took effect from the tax year 2019 onwards, reflecting the ongoing effort by the IRS to respond to taxpayers' needs.

IRS Form 1095-B: Eligible Taxpayers

Determining your eligibility for utilizing the 1095-B tax form can be a daunting task, but it doesn't have to be. It's quite simple, actually.

- If you are insured by a company that is not part of the government or if you are covered by a self-insured employer, then you are generally eligible to get the 1095-B tax form.

- On the other hand, people who are insured by a government scheme like Medicare or CHIP are not generally required to use this form.

Tips for the 1095-B Form Submitting

Now that you understand the basics of this form, we want to help you optimize its benefits. To do this, it's important to keep the printable tax form 1095-B for your future reference. Not only does it serve to validate the duration of your health coverage, but it also provides proof of your dependents' coverage. Even though this form is not required to be attached to your tax return, it can be a valuable tool in the event of a tax audit.

Understanding the IRS 1095-B tax form is an important element of organizing and preparing your taxes. Knowledge is power - the more you know, the easier it is to navigate through the tax season.

Latest News