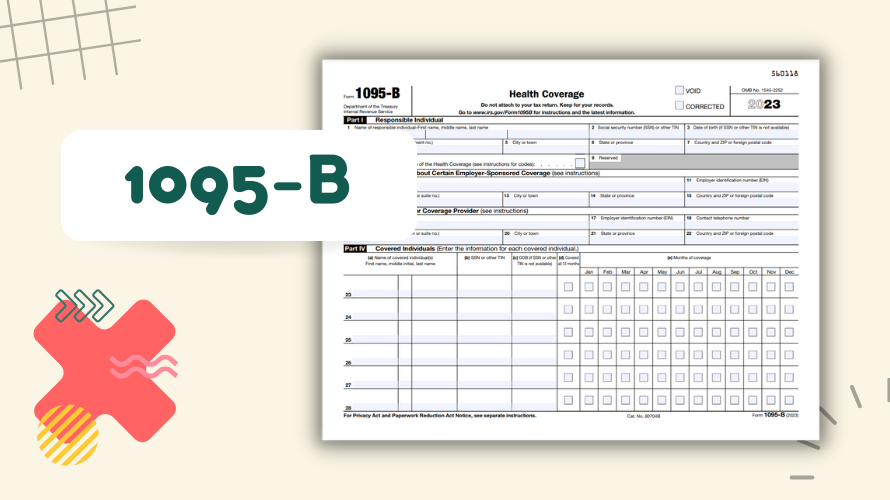

IRS 1095-B Health Coverage Form

When tax season rolls around, there are several forms you might need to fill out. One that often causes confusion yet is vital is IRS Form 1095-B (Health Coverage). It's there to help you handle and report your health coverage information accurately. But don't worry - once you understand its purpose and how to complete it correctly, filling it out will be a piece of cake!

The IRS 1095-B Health Coverage Tax Form Purpose

In a few words, the IRS 1095-B health coverage form is a tax document issued by the Internal Revenue Service. Its primary purpose is to report specific information about your health insurance if an insurance provider covered you or a family member. In simple terms, it's proof for the IRS that you did indeed have health coverage throughout the year to avoid tax penalties.

The 1095-B Tax Form: Essential Points

- Make sure to use your tax ID or Social Security number where needed.

- Double-check to ensure you enter the right dates for your coverage period.

- Be sure to include everyone in the family who was covered under the policy.

- Filing Form 1095-B is for your records, and the IRS does not require you to attach a copy to your tax return.

IRS 1095-B Form: Common Errors & How to Fix Them

If you're going to be filling out a Form 1095-B for coverage this year, there are some pitfalls to watch for:

- A common mistake is to mix up this form with others, like the 1095-A or 1095-C. Each form serves a different purpose, so ensure you are filling out the appropriate copy.

- Another error is not keeping a copy of your health coverage 1095-B form for your records. While it's not required to be submitted with your tax return, you should keep it in case any questions arise later on.

- Sometimes, when people switch insurance providers within the same year, they file only one form. Remember, you need to file a form for each insurer.

These tips should help you avoid the typical mistakes and give you a head start on your taxes this season.

Form 1095-B: Key Takeaways

To get started, you can download the 1095-B health coverage form in PDF format from the IRS website. The forms are available to be filled out and stored digitally or to be printed and filled out by hand, whichever is most convenient for you. Remember, doing your taxes doesn't have to be daunting or stressful, especially when you have the right knowledge and tools at your fingertips.

Latest News