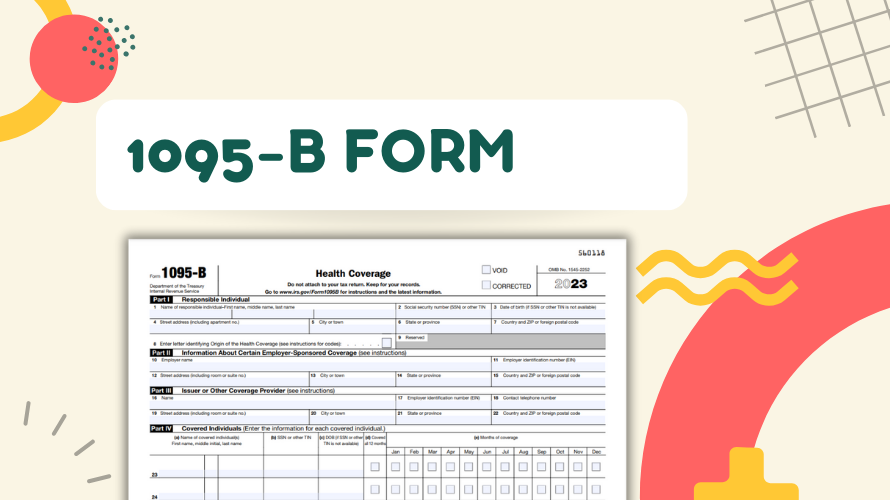

Blank IRS Form 1095-B

Handling tax forms can sometimes feel like solving a puzzle. However, with a clear understanding and the right information, it becomes a lot less daunting. Today, we'll explore one such essential form - the blank IRS Form 1095-B.

Examples of the 1095-B Tax Form Use

There are some scenarios where you might find yourself needing a blank 1095-B form. Let's take a look at a few instances and how they can be managed.

- Scenario 1

You're working two part-time jobs, and both provide health insurance coverage. In this case, you’ll receive two forms. Combine the information from both copies to complete your 1095-B blank form. - Scenario 2

You switched jobs in the middle of the year and carried health coverage over from your previous employer during the transition period. Here, managing your forms might be more complex, but remember to include details from both employers.

Comparing 1095-B & 1095-A Forms

At first glance, IRS forms 1095-B and 1095-A might look quite similar. But, there are key differences between these two. Let's compare them in the table below based on five criteria:

| Criteria | 1095-B | 1095-A |

|---|---|---|

| Issuer | Insurance providers | Healthcare Marketplace |

| Insurance Coverage | Employer-sponsored, private, Medicare, CHIP | Marketplace plan |

| Tax Credit Eligibility | No | Yes |

| Filing Requirement | It is not necessary to file taxes | Required to file taxes |

| Use | Proof of health coverage | Reconcile tax credit |

The IRS 1095-B Form: Popular Questions

To provide further assistance, here are three frequently asked questions about this form:

- Is it necessary to wait for Form 1095-B before filing taxes?

The IRS does not require you to attach this form when you submit your tax return. However, it is advisable to keep a copy for your records. While the information on the form can be useful in ensuring accurate tax reporting, you can estimate your healthcare coverage based on other records, such as insurance statements and Explanation of Benefits (EOBs). - What should I do if I lose my Form 1095-B?

You can request a replacement from your health coverage provider. They should be able to provide you with a copy of the form, ensuring you have the necessary documentation for your records and for tax-related purposes. It's a good practice to keep important tax-related documents in a safe and easily accessible place to prevent loss or damage in the future. - Can I download a blank 1095-B form for 2023 for free?

Yes, you can easily obtain a blank 1095-B template for the tax year 2023 at no cost. You can download and print the form from our website. Make sure to use the most recent version of the form and complete it accurately with your healthcare coverage details when you're ready to file your taxes.

We hope this guide helps, and remember, while taxes may seem complex, with the right information, they become less intimidating.

Latest News